Trading

information

Elevate your trading finesse with carefully curated resources that fuel informed decisions and set you on the path to market domination.

Education

Trading signalsAnalytical centerEducation for tradersProtection guideCustomers

Ways to make a depositWithdrawal ProcessAccount verificationF.A.Q.Trading condition

CompanyHow to start trading?Financial instrumentsMinimum DepositFinancial designationsLoyalty program

VIP clubBonus account systemF.A.Q. BonusesReferral programF.A.Q

General questionsPersonal accountFinancial issuesExchange tradingEducation

Trading signalsAnalytical centerEducation for tradersProtection guideSecurity

CybersecurityAccount protectionSuspicious activityRisk managementCustomers

Ways to make a depositWithdrawal ProcessAccount verificationF.A.Q.Cybersecurity is an essential component for any financial institution, crucial for safeguarding computer systems from threats such as viruses, data manipulation, and information theft. In today's interconnected landscape, cyber risks are increasingly prevalent, particularly in the financial sector.

While absolute immunity from these threats is unattainable, we prioritize data protection legislation and employ a range of tools to effectively shield our clients.

To assist you in safeguarding your personal data, our experts have compiled a quick guide with the following recommendations:

- Avoid sharing sensitive information on social media

Revealing sensitive details about yourself on social platforms can expose you to phishing attacks and attract cybercriminals. These criminals analyze the information you share to extract details about your job, income, and even your current location. It is crucial to exercise caution when posting personal information online.

The company provides advanced training for traders and employees, ensuring that best practices for managing their online presence are followed.

- Implement an email policy

Our organization uses specialized software that filters outgoing emails sent by employees. This preventive measure scans each email to eradicate potentially harmful content, significantly enhancing overall email security.

- Cybersecurity training

All employees with direct access to the trading platform undergo regular cybersecurity training. The company offers specialized courses and conducts simulated phishing attacks to evaluate employee competency. Those identified as needing further development receive additional training to deepen their understanding of cybersecurity practices.

- Compliance with anti-money laundering laws

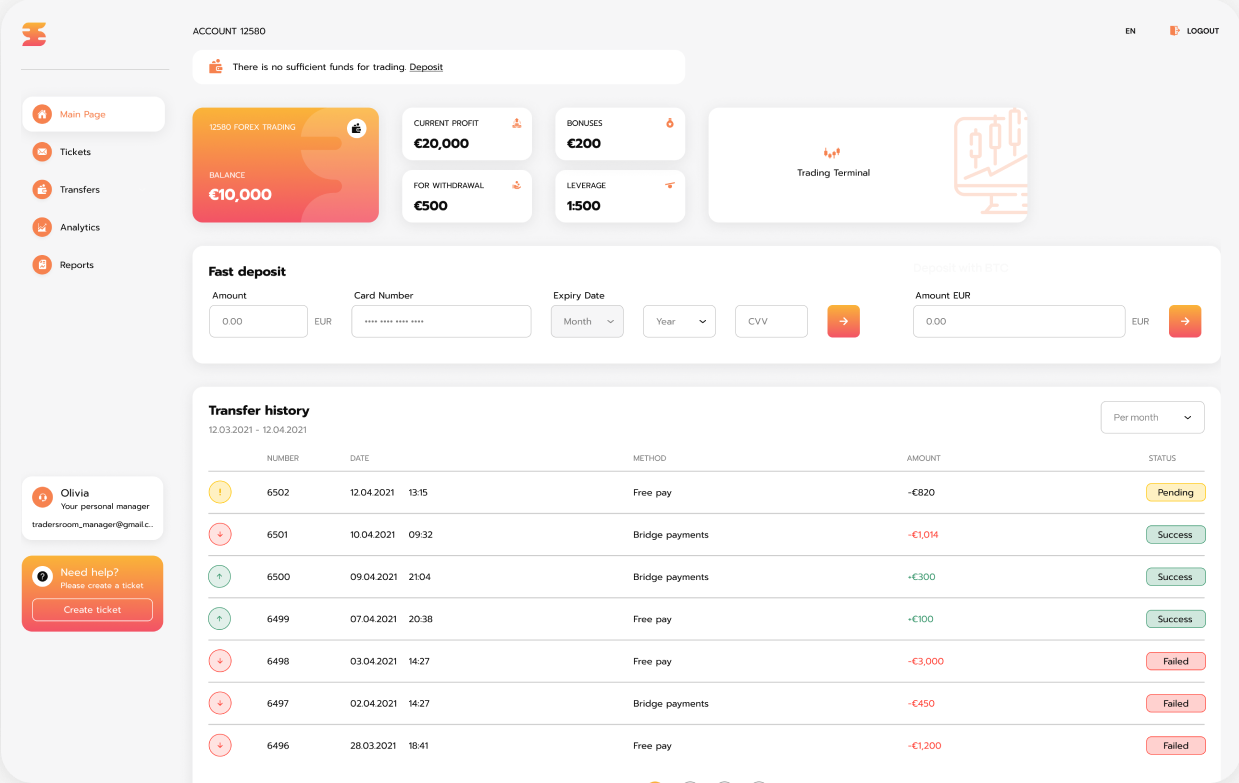

Company managers rigorously monitor customer accounts for any red flags or suspicious activities to combat money laundering. For instance, a sudden significant increase in withdrawals from an account that usually has minimal activity would raise concern.

Anti-money laundering laws mandate brokers to monitor and prevent such activities, carry out customer due diligence, and report withdrawals that exceed set thresholds to relevant authorities. This proactive stance helps mitigate financial losses even if a trader’s account is compromised.

We provide complex and unique passwords and secret codes to protect our customers. Additionally, the company performs daily infrastructure audits, regular security assessments, and maintains strict adherence to anti-money laundering and data protection laws. These measures ensure the highest level of security and privacy for our customers.