Reveal

Potential

Reach the heights of trading with us! We offer a wide range of trading accounts suitable for traders of all levels.

Get Started

First steps

How to Start Earning

1step

Think

Consider several ways to earn money on the exchange. Assess their advantages and disadvantages. Choose among them the most suitable for you.

2step

Choose

Find several tools on our platform for investing and choose among them the most suitable one. Register and open a minimum deposit.

3step

Earn and Learn

Try different approaches, learn from your actions, gain experience. Analyze your steps, work on your mistakes, improve your skills and strategies.

Features

Open a World of New Financial Opportunities

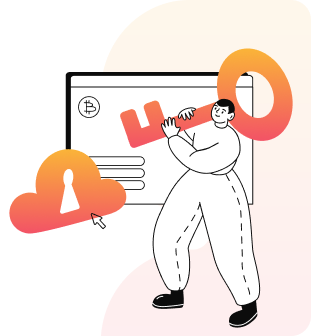

Investments

Explore a wide range of trading instruments, carefully selected for their high liquidity, allowing you to make optimal investment decisions.

Analytics

Gain access to exclusive market research empowering you to learn how to predict chart movements alongside our team of traders.

VIP Club

Join an international community of traders and unlock privileges that are typically unavailable to the majority of market participants.

Safety

The real-time margin calculation system reflects the market revaluation of all client positions, ensuring an accurate risk.

Explore a variety of options and trade with confidence, taking advantage of global market trends and making informed investment decisions.

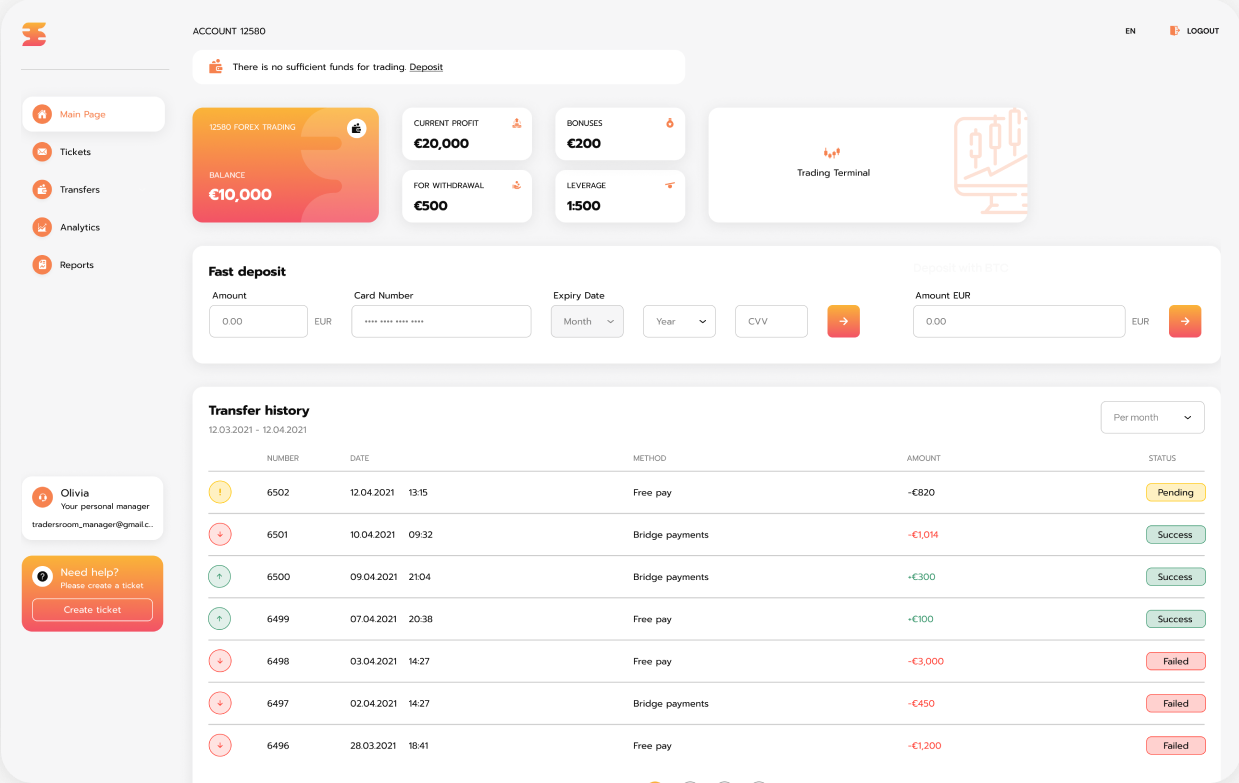

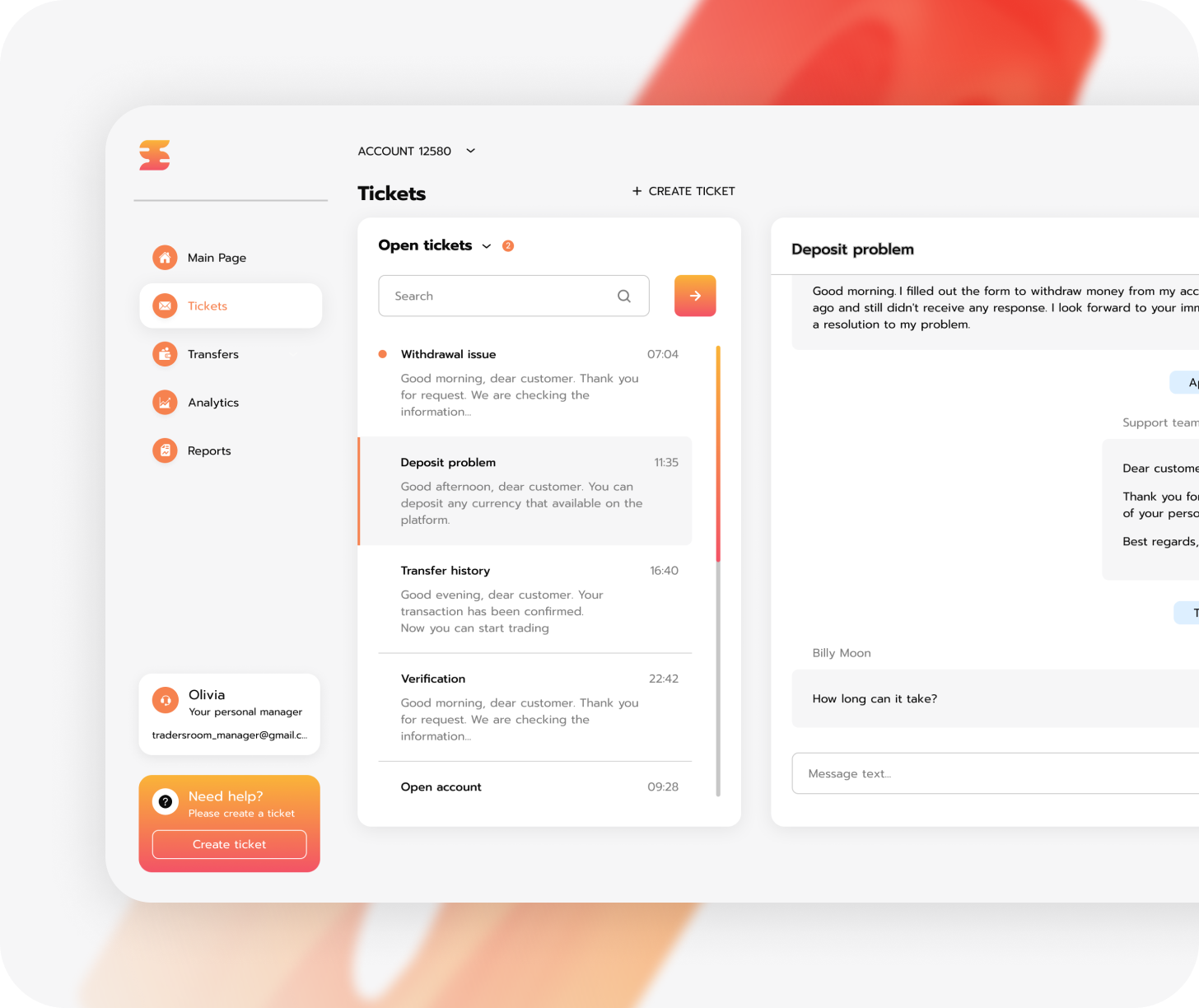

Custom reports

Personalized Reports Customized for Your Needs

Every trader has unique requirements for analyzing and monitoring their trading activity. That's why our company provides customized reports specifically tailored to each client's needs. Our team of professionals works closely with traders to create personalized reports that highlight performance metrics, market analysis or visualization of specific data.

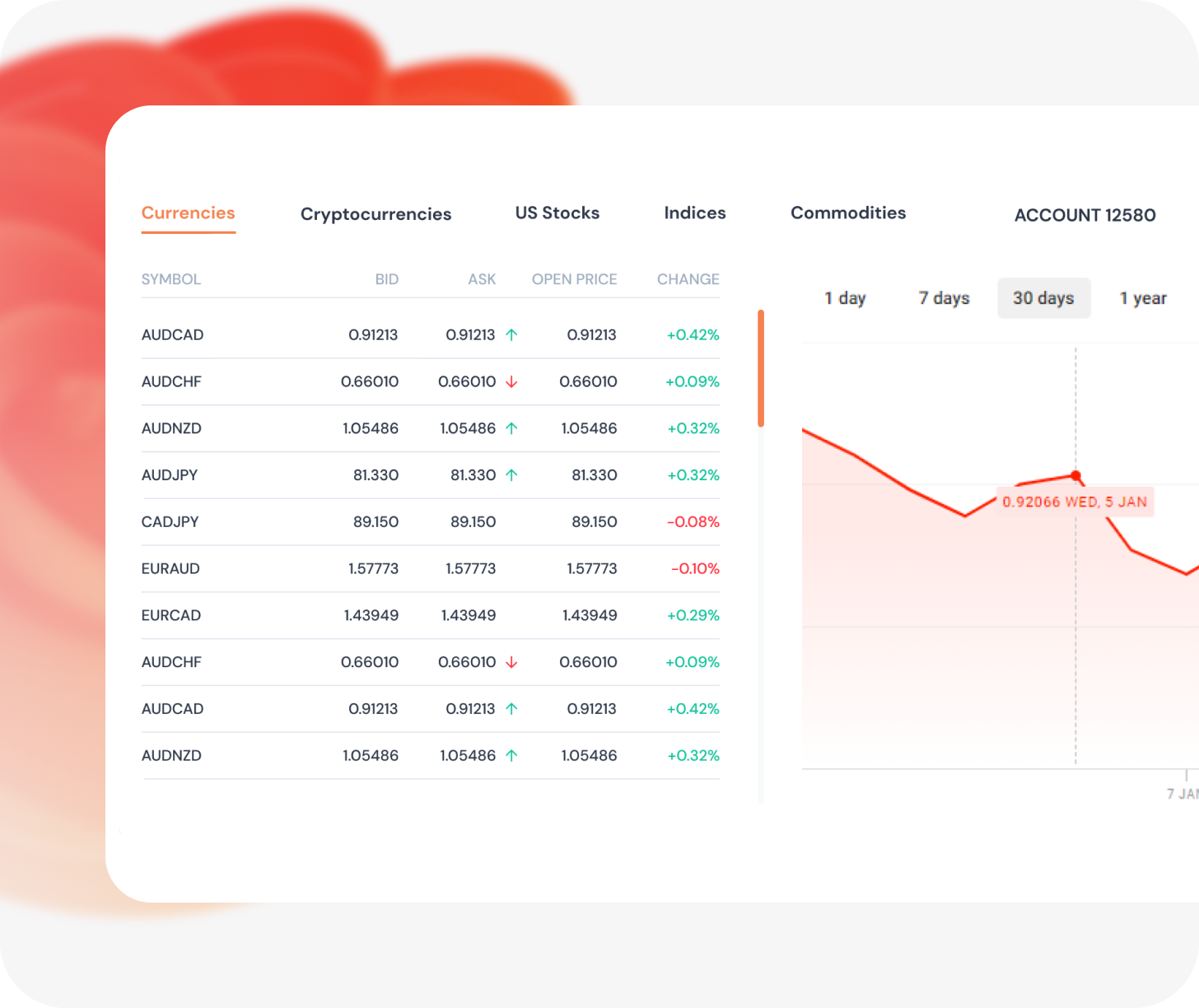

Personalized support

Comprehensive Support Service for Every Trader

Our company prioritizes effective communication with clients, providing a professional support service to address all financial inquiries related to trading. Our team of experts is always available to assist with any questions and ensure seamless trading experiences.

News

Stay Up to Date With the Trends and Happenings

02.03.2026

Retired Bank Officer Duped Of Rs 60 Lakh In Crypto Trading Scam In Agra

Understanding the Increasing Risks of Cryptocurrency Scams

In the ever-evolving world of finance and technology, cryptocurrency has emerged as a beacon of innovation, offering new opportunities for investment and profit. However, it has also become a fertile ground for cybercriminals to exploit unsuspecting individuals. The recent incident in Agra, where a 77-year-old retired bank employee was duped of nearly Rs 60 lakhs, highlights the pressing need for awareness and vigilance in navigating the digital financial landscape.

The Anatomy of a Cryptocurrency Scam

Scams such as the one experienced by Krishna Gopal Sharma typically involve a well-crafted approach to gain the victim's trust. The fraudster in this case used a Facebook Messenger platform to initiate contact, an increasingly common method due to its vast user base and accessibility. Posing as 'Anna', and leveraging the reputable name of a global investment firm, Morgan Stanley, they meticulously constructed an illusion of security and authenticity.

The Psychological Play: Building Trust

Cybercriminals often rely on psychological tactics to manipulate their victims. By suggesting affiliation with a respected firm, the scammer was able to breach Sharma’s initial guardrails of skepticism. This tactic is known as 'social engineering', where trust is manufactured using deceptive cues that mimic legitimacy. Many fall victim to such schemes due to the complex blend of fear of missing out (FOMO) on lucrative opportunities and a false sense of security provided by known brand associations.

The Mechanisms of the Scam: Financial Transactions

Once trust is established, the next step in these scams typically involves setting up a trading account and a crypto wallet. This creates an illusion of genuine participation in a profitable enterprise. In Sharma's case, the process was facilitated with a link sent by the accused, likely designed to appear authentic and possibly linked to a phishing site to capture sensitive information. Over a substantial period, from October 2024 to January 2026, Sharma transferred Rs 60 lakh in multiple instalments via UPI transactions, a popular but sometimes vulnerable payment method.

Protect Yourself: Essential Precautions in Cryptocurrency Trading

The global trend towards digital currencies necessitates a proactive approach to security. Here are some key precautions to consider:

- Research: Before engaging in cryptocurrency trading, conduct thorough research. Verify the credentials of investment firms and individuals. Well-known companies have clear online presences and histories that are easy to corroborate.

- Communication Verification: Be skeptical of unexpected messages from unknown contacts on social media platforms. Always double-check the identity of the sender and the authenticity of the communication channel.

- Secure Transactions: Use established and verified platforms for financial transactions. Be wary of links or platforms shared by individuals that are not verified with official websites.

- Education: Stay informed about the latest cybersecurity trends and scams. Educational resources, online courses, and financial literacy programs can enhance your defenses against fraudulent activities.

The Role of Authorities and Financial Institutions

In light of increasing digital financial crimes, authorities and financial institutions have a significant role in safeguarding consumers. Law enforcement agencies, like the cybercrime police station that Sharma approached, are crucial in tracking and prosecuting cybercriminals. Meanwhile, financial institutions must innovate in security technology, user education, and fraud prevention strategies to protect their customers.

Conclusion: Navigating the New Financial Frontier

The prevalence of scams in the cryptocurrency sector serves to remind us of the dual nature of technological advancement. While it opens up new avenues for growth and prosperity, it also presents challenges that both individuals and institutions must address. By fostering a culture of vigilance, awareness, and continuous learning, we can better equip ourselves to thrive in this digital financial frontier without falling prey to its pitfalls.

27.02.2026

If Bitcoin's Price Falls 20% Tomorrow, Most Retail Traders Are Ready To Buy The Dip

Bitcoin's Prolonged Struggle: Why Investors Are Eyeing the Dip

Bitcoin continues to capture the financial markets' attention, not so much for its record-shattering performance, but rather due to its recent struggles and the divided investor responses. According to an ongoing poll on Stocktwits, only 17% of users have expressed their confidence in holding onto their Bitcoin holdings amid recent downturns. The cryptocurrency's price has been hovering in a range-bound movement over the last two weeks, consistently trading below the $70,000 mark after peaking earlier this year. It edged lower in the last 24 hours, extending a 12% decline observed over the past week, indicating shaky investor confidence alongside optimism for a rebound.

Market Sentiment: A Buying Opportunity?

Despite Bitcoin's recent downturn to around $67,600—a dip of 0.8% over the last day—there's still a flicker of optimism within the investor community. The prevailing sentiment has shifted to 'neutral' from a previously 'bullish' stance, yet mercifully hovers above 'bearish'. Currently, two-thirds of traders, according to Stocktwits, are poised to purchase additional Bitcoin if its price falls by another 20%, bringing it below $54,000. This sentiment, reflecting retail investors’ willingness to 'buy the dip', contrasts with 24% of traders ready to panic-sell or trim their holdings. It's a stark indicator of the market's inherent volatility and the fear of missing out (FOMO) that often accompanies it.

Retail Investors: Resolute or Reckless?

Although Bitcoin is not particularly the most attractive asset right now, the resilience of retail investors is noteworthy. Some investors have expressed an eagerness to expand their buying capabilities dramatically, anticipating further price drops. Nevertheless, others remain skeptical, predicting Bitcoin’s potential to plummet another 50% before they consider buying. This divergence in strategies underscores the diverse risk appetites and predictions among market participants.

Broader Market Impact: Sentiment and Regulation

The broader cryptocurrency market has been marred by a growing wave of pessimism, exacerbated by regulatory developments and alleged market manipulations. Notably, allegations that Jane Street contributed to the 2020 crypto crash by manipulating prices has resurfaced anxieties over market stability. Meanwhile, regulatory changes loom on the horizon, with the Office of the Comptroller of Currency (OCC) proposing new rules under the GENIUS Act that might affect stablecoin rewards.

Regulation and the Road Ahead

The regulatory environment remains a critical factor influencing market sentiment. The CLARITY Act, which could potentially reshape market structures, hangs in balance as its approval deadline approaches. According to JPMorgan, the Act’s approval could revitalize the crypto markets, providing much-needed clarity and possibly encouraging stronger market participation.

In light of ongoing regulatory uncertainties and market sentiment shifts, Bitcoin's future remains uncertain yet filled with potential. Whether the buy-the-dip strategy pays off or cautious skepticism prevails will be chiefly determined by how the market adapts to imminent regulatory and macroeconomic shifts.

26.02.2026

Blockchain for Good: How Digital Assets Drive Positive Impact

The Shifting Landscape of Blockchain Technology

The conversation around blockchain technology is undergoing a significant shift. Traditionally synonymous with the volatility of cryptocurrency markets, blockchain is now being explored for its vast potential in promoting social good. A recent conference held in London, aptly named "Crypto for Good," illustrated this evolving narrative, showcasing initiatives that leverage blockchain to enhance charitable giving, promote environmental sustainability, and improve transparency across various sectors.

Transforming Skepticism into Understanding

As an attendee of the event, my initial skepticism, shaped by the notorious scams and market manipulation within the "crypto" space, was quickly dispelled. During the conference, the focus wasn't on speculative trading but rather on the core attributes of blockchain technology: immutability, transparency, and security, and how these features are being used to solve real-world problems. The discourse centered on practical applications rather than market speculation, highlighting an essential shift in perception.

Reframing the Narrative of Blockchain Utilization

A pivotal takeaway from the conference was the imperative to reframe the blockchain narrative. Lavinia Osborne of Women in Blockchain Talks articulated that the dialogue surrounding "crypto for good" is not merely an option; it is a necessity. She emphasized, "The fintech and blockchain community possesses immense technical capability, and aligning this innovation with purpose ensures technology not only advances markets but also society." Osborne underscored the importance of ESG (Environmental, Social, and Governance) principles, sustainability, and philanthropy, which are crucial for bridging the trust gap between traditional finance and emerging digital ecosystems.

Examples of Blockchain Driving Positive Change

Several initiatives are emblematic of this paradigm shift. Traceport.io, under the leadership of Bridget Doran, has introduced an API that facilitates the creation of a "provable" record of events without necessitating deep technical expertise. Their "Traceport for Charities" platform specifically addresses the demand for transparency in charitable donations. As Doran explained, "Traceport helps charities create a permanent, public proof of actions such as receiving donations or funding programs, without exposing sensitive information on the blockchain." By utilizing cryptographic fingerprints that are verifiable by anyone, the system builds trust and accountability.

Blockchain Enhancing Transparency and Accountability

This approach is invaluable in today's saturated funding environment, where donors seek assurance that their contributions are being utilized effectively. Doran asserts that highlighting these "blockchain for good" projects is essential to counteracting the negative perceptions associated with cryptocurrency trading. She noted, "The benefit of blockchain becomes apparent when it remains in the background, enhancing trust and transparency, without requiring users to understand its technical intricacies."

Blockchain's Impact on Carbon Markets

Beyond charitable endeavors, blockchain is also being considered a potential game-changer in improving the integrity of carbon markets. Owen Vaughan of Bitroots elaborated on a conference panel how blockchain can address pervasive issues like double-selling and the lack of transparency in carbon credit trading. "Technically, blockchain ensures data uniqueness and completeness in a digital realm. By issuing carbon credits on the blockchain, one can be certain of their uniqueness, preventing double-selling, while completeness ensures transparency," Vaughan explained.

Promoting Positive Perceptions of Blockchain

Vaughan further addressed misconceptions about Bitcoin mining, sharing insights into how it can monetize wasted electricity at renewable energy sites and even provide disaster relief by temporarily reallocating power during emergencies. Instances of Bitcoin miners voluntarily reducing operations during severe weather in the U.S. to prioritize domestic power supply exemplify this potential.

A Renewed Vision for Blockchain's Role in Social Good

The palpable optimism surrounding blockchain's positive impact was undeniable at the conference. This sentiment extends beyond this event to future gatherings like the London Finance Summit and Women in Tech events, where discussions will continue to evolve. Osborne's forthcoming event, focusing on women in Web3, aims to further explore inclusive innovation and the intersection of technology and impact.

Unlocking Blockchain's True Potential

The key to unlocking blockchain's potential for good lies in narrowing the focus from financial speculation to practical applications addressing real-world challenges. By prioritizing transparency, accountability, and social impact, the blockchain community can build trust and demonstrate the transformative value of this technology. The projects highlighted at the "Crypto for Good" conference provide a preview of a future where blockchain doesn't just serve financial markets but fosters a more equitable and sustainable world.

19.02.2026

Growing demand for ASIC mining infrastructure in India

Weekly Career Horoscope for February 16 - 22: Family-Related Expenses May Require Attention

The alignment of the stars this week suggests that family-related expenses might necessitate your immediate focus. It is crucial for each zodiac sign to pay attention not only to their career prospects but also to the financial dynamics within their household. This awareness is especially significant during these times of rapid economic changes and uncertainties. While pursuing career goals, it is vital to balance both professional and personal monetary commitments.

India's Rapidly Growing Digital Economy

India’s digital economy is experiencing swift growth, driven by innovative fintech businesses and the adoption of blockchain technology. This burgeoning sector plays a pivotal role in transforming India's economic landscape and computational capabilities. A notable highlight of this shift is the rise of bitcoin mining, which harnesses specialized equipment known as ASIC miners. As bitcoin garners increasing attention from investors, companies, and tech enthusiasts alike, the demand for robust and organized bitcoin mining technology is intensifying.

Rising Awareness of Cryptocurrency Mining in India

The term “Crypto miner India” is becoming a staple in technological discussions, signifying an increased awareness about organized mining systems. However, future prospects for bitcoin mining extend beyond merely acquiring equipment. It's about orchestrating a comprehensive strategy involving power planning, stabilization, and cooling systems—a juncture where ASIC mining infrastructure becomes critically important.

The Role of Bitcoin Mining in India's Digital Asset Ecosystem

India's digital ecosystem has expanded briskly with the surge of smartphone usage, digital payments, and blockchain technology integration. These advancements are laying the groundwork for a sustainable bitcoin mining community in India. While cryptocurrency trading retains its popularity, bitcoin mining has emerged as an integral component of India’s broader digital asset management infrastructure.

The Expansion of ASIC Mining Infrastructure

ASIC mining infrastructure refers to the comprehensive system that supports ASIC miners—machines specifically designed for the task of bitcoin mining. Unlike traditional equipment, ASIC miners are dedicated to solving cryptographic puzzles, making them highly efficient. This infrastructure comprises power supply, cooling mechanisms, and network stability to support continuous mining operations.

Efficiency and Growth of ASIC Technology in India

ASIC miners are heralded for their efficiency and energy processing capabilities, outperforming previous GPU configurations. Their specific design optimizes energy usage and minimizes waste, which is why the demand for ASIC mining hardware is steadily rising in India.

Factors Driving Demand for ASIC Infrastructure in India

The burgeoning demand for specialized bitcoin mining machines in India is driven by the quest for secure and structured operations, both from large enterprises and smaller ventures. Crypto miner setups now prefer managed facilities over ad-hoc home arrangements, seeking reliability and efficient supply chain systems.

Challenges in Energy, Regulation, and Supply Chain

Bitcoin mining's energy consumption has implications for electricity infrastructure, necessitating preparations to mitigate grid stress. While India currently allows bitcoin mining, businesses must adhere to evolving local regulations regarding taxes and electricity. Supply chain localization is another challenge, highlighting the need for a robust domestic infrastructure to enhance efficiency and streamline processes.

Significance of Domestic Infrastructure Providers

Local infrastructure providers are playing an increasingly crucial role in supporting India’s cryptocurrency mining landscape. Companies, such as Bharat Miners, provide essential support by ensuring the credibility and reliability of ASIC hardware, mitigating risks, and enhancing stability for potential miners in India.

Future Outlook for India's Mining Hardware Industry

Looking ahead, demand for cryptocurrency hardware in India is poised to rise, with efficiency remaining a pivotal concern. ASIC miners will likely dominate given their superior performance metrics. The evolution of mining technology, alongside regulatory clarity, will shape the industry's landscape, fostering responsible growth and minimizing misuse. For people aiming to assess mining profitability accurately, tools such as miningnow.com offer valuable insights into performance under varying electricity conditions.

Conclusion

The rapid evolution of bitcoin mining in India represents a shift towards a more organized digital infrastructure. The advancement and regulation of the ASIC industry will significantly influence the trajectory of India’s digital economy. Understanding the infrastructure beyond just machines is pivotal to building a secure Bitcoin mining ecosystem. Through strategic planning and regulatory clarity, India has the potential to integrate bitcoin mining seamlessly into its fast-evolving digital economy.